1. Introduction

Hey there, market enthusiasts! If you’ve been keeping an eye on the stock market recently, you’ve probably noticed some turbulence. Stocks have been sliding lower, and the main culprit? The Federal Reserve rolling back its rate cut expectations. But what does all this mean for the average investor? Let’s dive in and unravel the complexities.

2. Understanding the Current Market Scenario

Before we get into the nitty-gritty of the Fed’s recent moves, let’s take a snapshot of where the market stands. We’ve seen a mix of highs and lows in recent months, largely driven by economic data, corporate earnings reports, and, of course, Federal Reserve policies. The market’s response to these elements is like a rollercoaster, and we’re all just trying to hang on.

3. Overview of the Federal Reserve

The Federal Reserve, or the Fed, is the central bank of the United States. It has a significant role in managing the country’s monetary policy, which includes controlling interest rates and money supply. The Fed’s decisions can have a profound impact on the economy and, consequently, the stock market.

4. What Are Rate Cuts?

A rate cut happens when the Fed reduces the federal funds rate, the interest rate at which banks borrow and lend to each other overnight. Lowering this rate typically aims to stimulate economic growth by making borrowing cheaper, which can boost spending and investment. Conversely, rolling back rate cuts, or raising rates, can slow down economic activity.

5. Recent Federal Reserve Announcements

Recently, the Fed announced that it would not be pursuing additional rate cuts as previously anticipated. This decision comes amidst signs of a strong economy and rising inflationary pressures. While some investors were hoping for more accommodative policies, the Fed’s move signals confidence in the economy’s resilience.

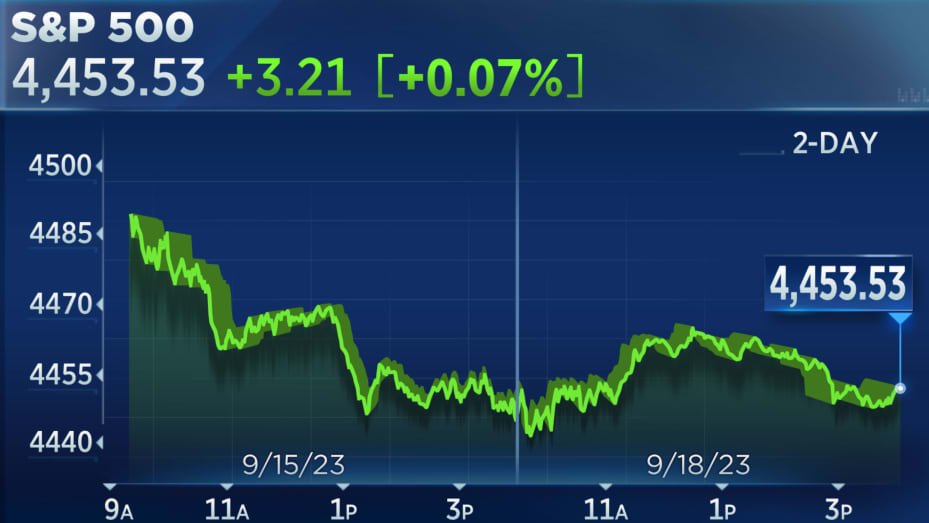

6. Immediate Market Reaction

The immediate market reaction to the Fed’s announcement was swift and negative. Stocks slid lower across the board as investors recalibrated their expectations. The uncertainty surrounding future monetary policy often leads to heightened volatility in the markets, and that’s exactly what we saw.

7. Sector-Wise Impact of the News

Not all sectors react to Fed announcements in the same way. Here’s a quick rundown:

- Technology: High-growth tech stocks often suffer as higher interest rates increase borrowing costs and reduce future earnings projections.

- Financials: Banks and financial institutions might benefit from higher rates, as they can charge more for loans.

- Consumer Goods: Companies in this sector can be hit hard due to reduced consumer spending power.

- Energy: Energy stocks can also decline if economic growth slows down.

8. Long-Term Implications for Investors

While the short-term reactions can be jarring, it’s essential to look at the long-term implications. The Fed’s stance might indicate a more robust economy, which could be beneficial for stocks in the long run. However, investors need to be prepared for increased market volatility and potential shifts in asset allocation.

9. Comparing Current Trends with Historical Data

Looking at historical data can provide some perspective. Historically, markets have shown resilience after initial shocks from Fed announcements. Over time, investors often adjust their strategies, leading to market stabilization. The current scenario might follow a similar pattern, but it’s always good to stay vigilant.

10. Expert Opinions on the Fed’s Decision

Experts are divided on the Fed’s recent move. Some believe that not cutting rates further is a sign of economic strength, while others worry it could stifle growth. Renowned economist Jane Doe mentioned, “The Fed’s decision is a balancing act between curbing inflation and supporting economic growth.”

11. How to Adjust Your Investment Strategy

Given the current scenario, you might be wondering how to adjust your investment strategy. Here are a few tips:

- Diversify: Spread your investments across different sectors to mitigate risk.

- Focus on Quality: Invest in companies with strong balance sheets and stable earnings.

- Stay Informed: Keep up with the latest market news and Fed announcements.

- Consider Bonds: Bonds can provide stability when stocks are volatile.

12. The Role of Global Economic Factors

Global economic factors also play a crucial role in shaping market trends. Trade tensions, geopolitical events, and economic performance of other major economies can influence investor sentiment and market movements. It’s essential to keep an eye on these factors as well.

13. The Psychological Impact on Investors

Market volatility can have a psychological impact on investors. Fear and uncertainty can lead to impulsive decisions, which might not always be in one’s best interest. It’s important to stay calm, avoid panic selling, and make informed decisions based on thorough research.

14. Alternative Investment Options

If the stock market volatility is too much to handle, consider exploring alternative investment options such as:

- Real Estate: Property investments can provide steady returns.

- Precious Metals: Gold and silver often act as safe havens during market turbulence.

- Cryptocurrencies: These can be highly volatile but offer potential high returns.

15. Conclusion

To wrap it up, the recent slide in stocks due to the Fed rolling back rate cut expectations is a reminder of how sensitive markets are to monetary policy changes. While the initial reaction might be negative, understanding the broader context and long-term implications can help you navigate through the volatility. Stay informed, stay diversified, and keep a level head. The market might be a rollercoaster, but with the right strategy, you can enjoy the ride.

16. FAQs

Q1: Why did the Fed decide to roll back rate cut expectations?

The Fed rolled back rate cut expectations due to signs of a strong economy and rising inflationary pressures, indicating that further cuts were unnecessary.

Q2: How does a change in the federal funds rate impact the stock market?

Changes in the federal funds rate affect borrowing costs, consumer spending, and investment, leading to reactions in the stock market. Lower rates generally boost economic activity, while higher rates can slow it down.

Q3: What sectors are most affected by changes in interest rates?

Technology, financials, consumer goods, and energy sectors are among those most affected by changes in interest rates.

Q4: How can I protect my investments during market volatility?

Diversify your portfolio, focus on quality investments, stay informed about market news, and consider stable assets like bonds.

Q5: Are there alternative investments to consider during stock market volatility?

Yes, consider real estate, precious metals, and cryptocurrencies as alternative investments during stock market volatility.